Table of Content

Today’s leading accounting platforms offer standard security features such as data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe. If you’re on a budget, you can reduce costs by opting for a less expensive plan, choosing à la carte options or only paying for the features you need. Its Elite plan is $120 per organization per month, and includes forecasting and multi-currency handling. For $240 per organization per month, its Ultimate plan includes advanced analytics and 25 custom modules. With MarginEdge, you’ll pay $300 per month per location for access to all its services.

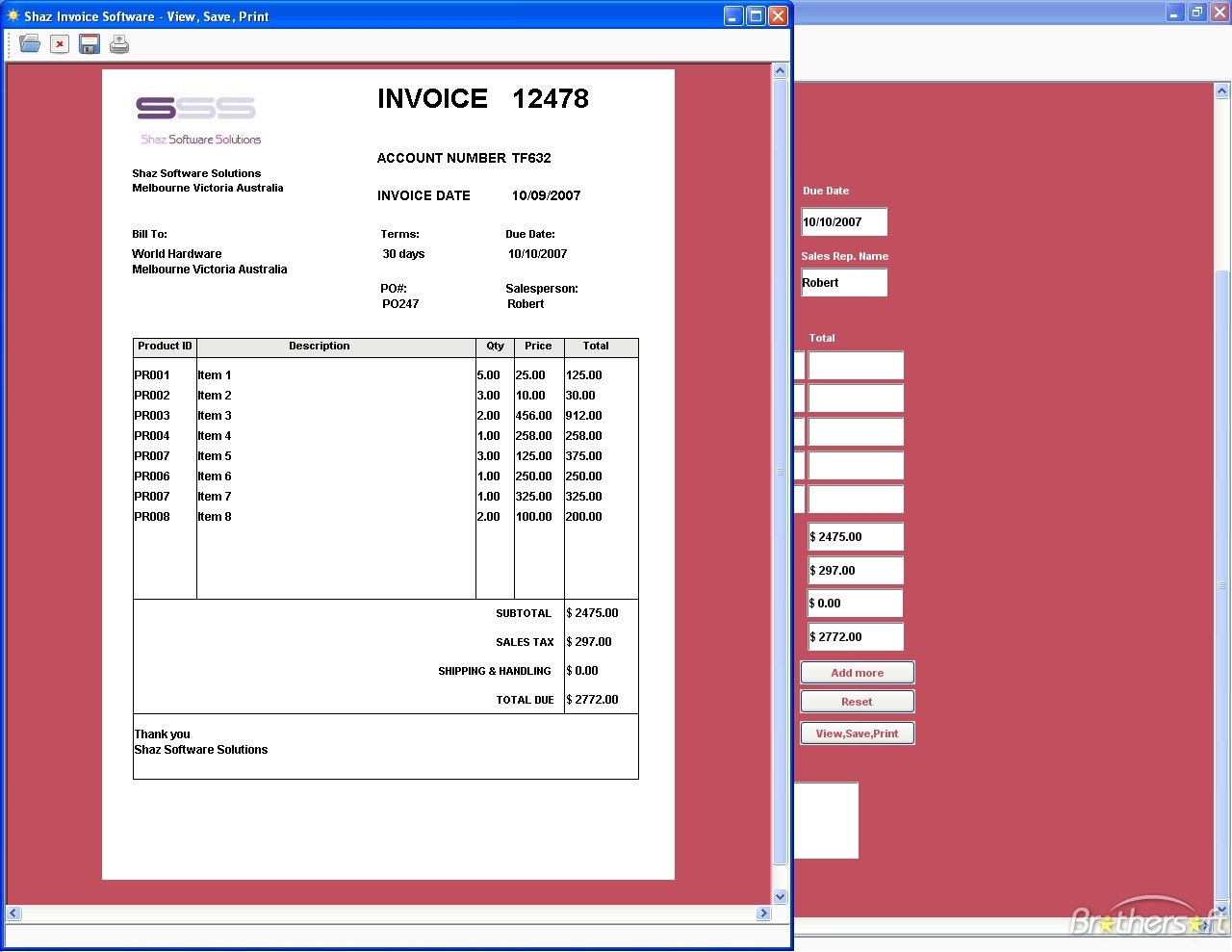

It is commonly employed for invoicing, maintaining records of customers, and keeping track of your inventory. With Wave, you don’t have to spend a lot of time learning the ropes of accounting software – it can be used by business owners who don’t have much money to invest in accounting software. Furthermore, Wave supports multiple businesses, additional users , and personal finance tracking. At $12 a month, Insightly offers small businesses the kind of CRM features that for which other software companies charge big bucks. All the features of this small business software are designed to automate CRM as much as possible. It offers contact management, project management, opportunity management and detailed sales reports.

What Does Small Business Tax Software Cost?

So while Kashoo isn’t as comprehensive as competitors like QuickBooks, Xero, and FreshBooks, its customer service reputation is a definite point in its favor. In spite of its excellent reports and recurring invoices, though, FreshBooks falls short in a few bookkeeping areas. Most notably, its cheapest plan ($15 a month) doesn’t include double-entry bookkeeping or free accountant access.

The makers of small business accounting software have worked hard to present this discipline as simply and pleasantly as possible. Some, including Intuit QuickBooks Online and FreshBooks, have been more successful at this than others. Depending on how long your business has been operating, getting started with a small business accounting website can take anywhere from five minutes to several hours after signing up for an account. Most of these sites charge monthly subscription fees and usually offer free trial periods. Early setup involves creating an account and answering questions like when your fiscal year starts and whether you use account numbers. In this story, we test and rate the top online accounting applications available to see what makes them different and which type of small business benefits most from using each one.

Best Risk Management Software for Businesses

Right out of the box, Shippo has all the basic features a business may need to run and automate its shipping operations right from the platform’s online dashboard. Shippo matches users with the lowest rates for both US and international shipping carriers, so your business can save on shipping costs. Founded in 2013, Shippo is a newer shipping platform that has quickly risen through the ranks and become a leader in the industry. Shippo rated a solid four out of five stars in its Merchant Maverick review and offers merchants of varying sizes a reliable and cost-effective shipping software platform.

It starts from the moment recruitment and hiring begins, covers performance management, employee development and effective communication. It continues through the establishment of proper protocols for employee separation and carries on well afterward. The multi-faceted requirements of human resources can present problems for even the most successful organizations.

The 9 Best Small-Business Accounting Software of 2023

There are many rivals, but Microsoft still provides the best office software suite, and Microsoft 365 delivers a cloud version you can use on the go as well as at home or in the office. That's why it's good to have a general idea of what different types of software are out there, so that the moment you identify a need, you can also identify a solution. We recommend the best products through an independent review process, and advertisers do not influence our picks.

Very small businesses could use it for basic money management, like sending invoices, monitoring financial accounts, accepting payments, and tracking income and expenses. More complex companies can add advanced tools that include projects and proposals, mileage and time tracking, and reports. Wave helps users connect multiple bank accounts and credit cards and set up profiles for multiple businesses to help keep track of income and expenses. The software organizes accounts, payments, and invoices to make tax time easier and also offers robust reports to help identify cash flow trends. Among the many features offered by Fiverr Workspace are the invoicing, expense tracking, time tracking, contracts, and reports that it offers as a freelancer management software.

Final Takeaway Thoughts On Shipping Software

Not only will you spend hours of your time painstakingly entering and categorizing data, but you'll have a harder time catching mistakes. Most accounting software also syncs with payroll software so you don't have to transfer your paycheck data into your general ledger by hand. Zoho Books has about as many features as QuickBooks at a lower price and a low additional user fee. Its free plan is perfect for freelancers who want solid reporting and financial tracking without any overwhelming bells and whistles (for instance, QuickBooks' dozens of customizable reports). Additionally, FreshBooks doesn’t include bank reconciliation with its cheapest plan.

Small businesses may be able to find a less expensive basic plan, while larger businesses may need to upgrade to a more expensive standard or premium plan. QuickBooks is a good choice for freelancers and small businesses that need a simple way to track expenses, organize receipts and log mileage. You can do a lot with these transactions once they appear in a register. For one thing, they should be categorized so you know where your money is coming from and where it's going. Every site guesses at how at least some transactions might be categorized. Conscientious categorization will result in more accurate reports and income tax returns.

With ZipBooks accounting software, you can simplify the confusing lingo and complexity of accounting by automating as many processes as possible. ZipBooks is known for its robust features, affordable pricing, and consistent updates. Its intuitive, colorful design offers several features, such as invoicing, contact management, project management, and time tracking. In addition, it features a color-coded design, making it easy to use and easy to navigate. FreshBooks offers more customizations for invoicing compared to other accounting software. Its primary function is to send, receive, print, and pay invoices, but it can also handle a business’ basic bookkeeping needs.

It integrates very easily with QuickBooks which can make your work much easier when it comes to accounting. All 2018 and newer versions of Quicken entitle users to 5GB of free Dropbox storage while subscription is in effect. The first thing going for Microsoft 365 is its familiarity - if you've used Microsoft Office before you'll easily find your way around this platform. Even if you haven't and have used rivals instead the same still applies because Microsoft Office is the market leader that others attempt to copy.

With each one, you’ll have to compromise on features or limits to users or storage, for example. Zoho CRM, monday.com and EngageBay are Forbes Advisor’s picks for the best free CRM plans. There are many types of CRM for different teams or needs, even though it’s traditionally used by sales teams.

No comments:

Post a Comment